India has the third largest fintech ecosystem in the world with The sector in India recorded a market size of $31 billion in 2021. The market has been steadily expanding due to the increase in digitization in the country. The recent entry of AI into the sector has further contributed to this growth.

Data as complex as it is of utmost importance especially to the BFSI market. The collection and correct usage of data can create a significant difference to the companies in the sector.

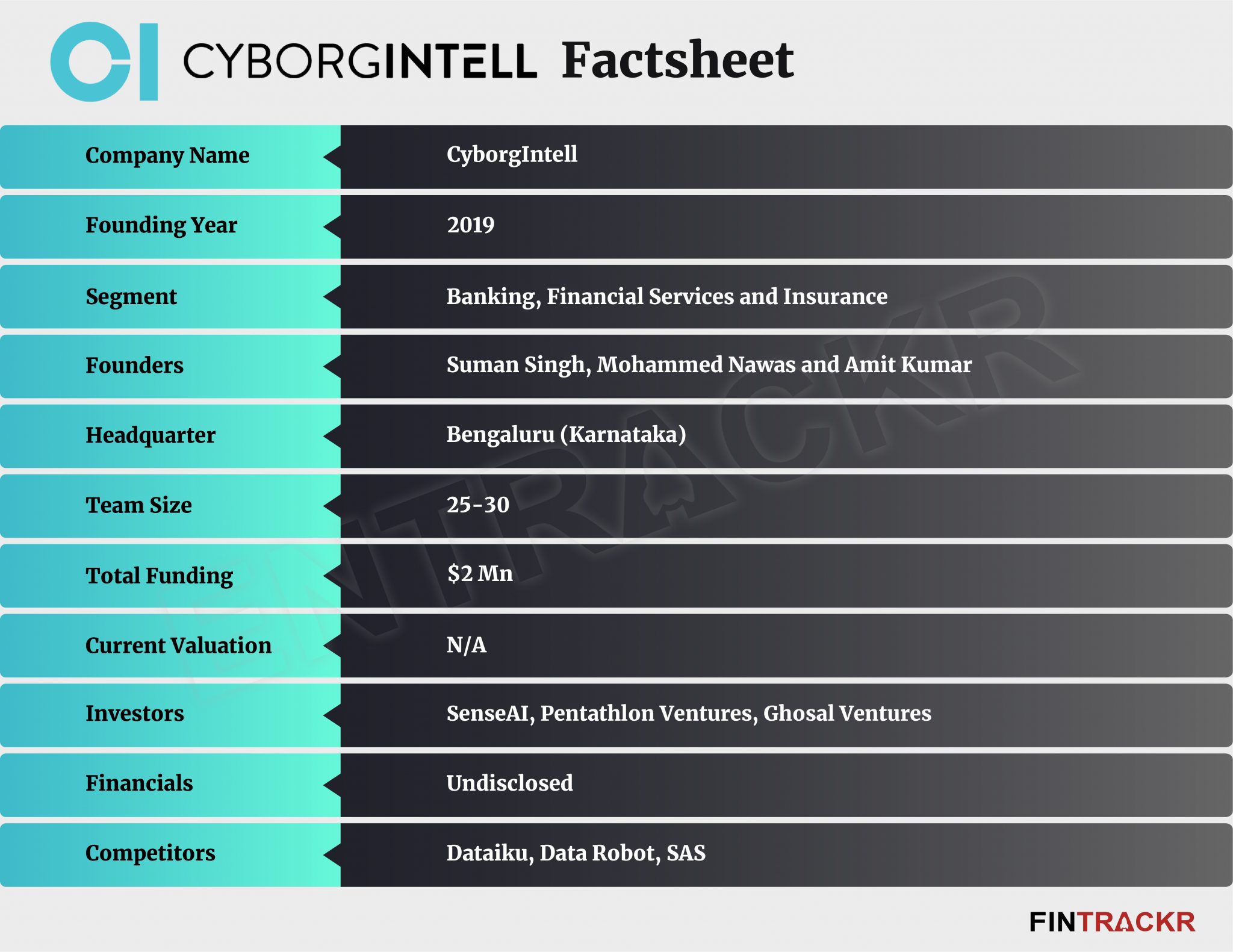

In order to help companies collect and process large amounts of data, help with the decision-making process and to assist companies to adopt AI technology; trio Suman Singh, Mohammed Nawas, and Amit Kumar founded CyborgIntell in 2019.

CyborgIntell is an enterprise AI software company for financial services, poised for simplifying AI & designed for better ROI. The company was set up to help companies take up AI using the company’s end-to-end Automated Data Science Machine Learning platform to accelerate the decision making process simpler and faster.

Co-founder and CEO Singh told Entrackr, “Our whole mission has been how we can simplify this AI and help our customer to generate a better ROI in a much faster, better and accurate manner.”

Among its key products are iTuring AutoML+ a zero-code auto AI that helps automate data science and machine learning, iTuring MLOps works along with the company’s DevOps platform and helps operationalize AI models for business impact, and iTuring Decision AI which helps organize the outputs of the predictive models and supplement them with policy driven rules.

Basically, iTuring cuts down turnaround time, aids in increasing efficiency, and assists in the delivery of new solutions, looking to increase a business’ ROI and save money by increasing precise and reliable business decisions.

The company has its headquarters in Bangalore, but it also operates offices in Johannesburg and Dallas. The platform licensing subscriptions generate the majority of the company’s revenue. It currently has around 40 active users.

A majority of CyborgIntell’s customer base consists of Tier-1 and Tier-2 banks, Tier-1 and Tier-2 insurance, digital lending, and housing finance companies.

The fintech company has received a total of $2 million in funding in its pre-series A funding round which saw participation from SenseAI, Pentathlon Ventures, and Ghosal Ventures.

The company is currently in discussions with fintech, insurance technology, and core banking solutions companies about developing analytical applications to extract value from their customer data through automation.

As part of its plans of expansion, the four-year-old company recently extended its operations to the US signing it a insurance company in North America. It further plans on expanding into new geographies within the North American market as well.

It currently faces competition from companies like Dataiku, DataRobot, and SAS. In order to get a stronger hold of the market globally as well, the company is also looking to tap into the Singapore, UAE, and Malaysia fintech markets.

Source: https://news.google.com/__i/rss/rd/articles/CBMidmh0dHBzOi8vZW50cmFja3IuY29tLzIwMjMvMDEvY3lib3JnaW50ZWxsLXNlZWtzLXRvLXNpbXBsaWZ5LWFpLW1hY2hpbmUtbGVhcm5pbmctaW4tb3JkZXItdG8taW1wcm92ZS1idXNpbmVzcy1vdXRjb21lcy_SAQA?oc=5